Urgent

City of Los Angeles Mills Act Program

Substantial changes to L.A.'s Mills Act Program are now under consideration. Since 2020, the program has been under review to assess program sustainability and equity.

UPDATE: The city of Los Angeles is currently in the process of updating their Mills Act program. Draft Policy Updates and Ordinance Amendments are available for public review on their Program Assessment webpage.

Overview

The Mills Act program is one of the most powerful historic preservation incentives for property owners. Today, combined Mills Act property owners in Los Angeles save over $20M in taxes. These savings are meant to be reinvested into rehabilitating and maintaining historic properties.

The program offers a property tax abatement through a revolving, auto-renewing 10-year contract between the City and the property owner. One major incentive for Mills Act recipients is that contracts are transferred to new ownership when the property is sold, who continue to receive the financial incentive.

In 2020, Los Angeles City Planning undertook a comprehensive, independent assessment (The Mills Act Program Assessment and Equity Analysis) to evaluate the program. The City has not accepted new contracts since then. In March 2025, they released draft recommendations to update and revive the Mills Act program.

About This Issue

The 2022 Mills Act Program Assessment and Equity Analysis assessment found that current funding is insufficient to effectively manage the number of contracts and to bring the program into complete compliance with state law.

The assessment also found that contracts and savings are disproportionately benefiting property owners in communities with lower barriers to opportunity. Through the assessment a number of recommendations were provided for program sustainability and program equity.

That 2022 Assessment Report was used to compile a Draft Policy Updates and Ordinance Amendments document, which was released publicly in March 2025. The proposals in this draft would drastically change how the Mills Act program works, and could negatively affect many currently participating in the program.

Our Position

The City of Los Angeles has launched the public process to update their Mills Act program. In a letter submitted on April 17 to the Cultural Heritage Commission, the Conservancy outlined its analysis of the proposed Mills Act changes and recommended several amendments.

We strongly oppose contract non-renewal and the elimination areas in Downtown and Hollywood.

Our detailed recommendations are listed below, following the framework established by the Draft Policy Updates and Ordinance Amendments, but please review our position letter for the full context.

Conservancy Comments on Proposed Changes

Distribute the Collection of Fees Equitably

Provide significant fee discounts for multi-family properties and introduce a cap to prevent excessive fee collection on larger buildings. (Proposed Administrative Change 2)

Maintain Current Contract Period and Renewal Policies

Retain current perpetual renewal practice for Mills Act contracts, discarding proposed 20 year phase-out. (Proposed Administrative Change 9)

Enable Fee Collection Only During Renewal Window

Consider amending older Mills Act contracts to enable fee collection only during 10 year renewal window. (Proposed Administrative Change 3)

Increase Single-Family Valuation Cap to $2.5M

Increase assessed value limits for single-family homes citywide to $2.5 million to account for inflation. (Proposed Ordinance Amendment 2)

Maintain valuation exemption areas in Downtown & Hollywood

Additionally grant a citywide exemption for ARO properties. (Proposed Ordinance Amendment 3)

Exempt Multifamily, Commercial and Industrial Properties from a Value Cap in Low Resource Area

Exempt multifamily, commercial and industrial properties from valuation caps in low resource areas. (Proposed Ordinance Amendment 4)

Expand Eligibility for Multifamily Properties Listed in the California and/or National Register

Expand eligibility of California and National Register properties only to multifamily properties. (Proposed Ordinance Amendment 7)

Include Rent Stabilization Ordinance (RSO) Housing in Multifamily Prioritization

Prioritize RSO properties in Low-Resource areas as a form of naturally occurring affordable housing. (Proposed Ordinance Amendment 8)

Discourage Use of the Ellis Act on Mills Act Properties

Cancel Mills Act contracts for properties using the Ellis Act to remove RSO units from the rental market. (Recommended additional amendment)

How You Can Help

Two community outreach events were held in April 2025 to gather feedback from the community.

A Feedback Form has also been created to gather input. Comments can be provided until May 23, 2025. You are welcome to use “Our Position” or read our position letter as a guide, but we also encourage you to personalize your responses.

You are strongly encouraged to attend and comment if you have a Mills Act contract on your historic building or are interested in applying

Timeline

Issue Resources

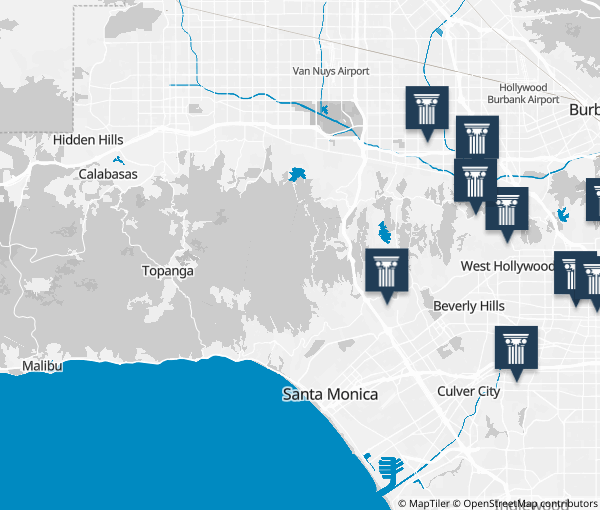

Relevant Places

Place

Eastern Columbia Lofts

Place

Chase Knolls

Place

Pacific Electric Lofts

Place

Laurelwood Apartments

Place

Oviatt Building

Place

Stahl House (Case Study House #22)

Place

The Village Green

Place

Continental Building

Place

Bailey House (Case Study House #21)

Place

STILE Downtown Los Angeles by Kasa and The United Theater on Broadway

Place

Bubeshko Apartments

Place

Barclay Hotel

Place

Gerry Building

Place

Farmers and Merchants Bank and Annexes

Place

Pacific Electric Lofts

Place

Blackstone Department Store Building

Place

Sowden House

Place

Kelton Apartments

Place

Tierman House

Place

E. A. K. Hackett House

Place

Bubeshko Apartments

Place

Petitfils-Boos Residence

Place

PacMutual

Place

The Wiltern and Pellissier Building

Place

Eastern Columbia Lofts

Place

Chase Knolls

Place

Pacific Electric Lofts

Place

Laurelwood Apartments

Place

Oviatt Building

Place

Stahl House (Case Study House #22)

Place

The Village Green

Place

Continental Building

Place

Bailey House (Case Study House #21)

Place

STILE Downtown Los Angeles by Kasa and The United Theater on Broadway

Place

Bubeshko Apartments

Place

Barclay Hotel

Place

Gerry Building

Place

Farmers and Merchants Bank and Annexes

Place

Pacific Electric Lofts

Place

Blackstone Department Store Building

Place

Sowden House

Place

Kelton Apartments

Place

Tierman House

Place

E. A. K. Hackett House

Place

Bubeshko Apartments

Place

Petitfils-Boos Residence

Place

PacMutual

Place